Investing in NFTs is one thing, but investing in NFT stocks is another beast. Many of the NFT stocks to invest in are actually just beginning to wade into NFT waters. So none of the firms on this list of NFT stocks exclusively rely on revenues from NFTs. But many are NFT marketplace stocks (and by stocks we mean the company underneath), selling blockchain-backed digital tokens, while others are using NFTs as marketing tactics.

An NFT is a non-fungible token.

Was that a “What?” from the back of the room?

Let’s break that down a bit. Non-fungible means one-of-a-kind. And the token is basically any sort of digitised content.

It could be a digital image of an NBA trading card or a digital MP3 sound byte of you singing in the shower. Whatever it is, it’s entirely unique and un-copyable. It cannot be replaced.

Your mind probably wandered to one of two places when you read that.

If you fall in the first camp, you’ve had the NFT spiel explained to you before. You’re not interested in hearing more about those digital pictures (“there’s not even a hard copy?”) that can sell for millions of dollars. You’re likely incredulous, perhaps sceptical, of how and why these things rose to such heights during the pandemic.

If you’re in the second camp, you understand what an NFT is. You understand its immutable nature. You get that can essentially include anything digital so long as the data is stored on the blockchain.

Or, you might fall somewhere in between the two. But those three letters undoubtedly tend to attract some strong sentiment on both sides.

Read more

When it comes to investing in NFT stocks, we’re not talking about investing in NFTs directly. We’re looking at companies investing in NFTs themselves, or using the technology in another indirect way.

It’s not all about pixelated ape JPEGs. ‘Smart contracts’ are the technology driving NFTs. NFTs are minted through smart contracts, which assign ownership and manage their transferability when they’re bought or sold.

These coded programs are stored on the blockchain and they’ll only run when specific conditions are met.

So they’re self-executing, but only if the exact terms of the agreement have been met.

Beyond NFTs, smart contracts could automate workflows, like registering a newly bought vehicle as soon as you pay for it. Or they might send notifications from one department to another. They’re instant, paperwork-free, and encrypted.

Another key feature of NFTs is their decentralised nature.

When we talk about blockchain stocks what we really mean is stocks connected to the emerging theme of the blockchain. Which begs the question, what is the blockchain?

The blockchain is a decentralised, public ledger. It’s made up of “blocks” which get filled up with data. Once they’re all full, the block closes and links up to the previous block. That chain of data makes the blockchain.

Some cryptocurrencies have their own respective blockchain. It’s essentially the technology powering the cryptocurrency.

NFTs use that same blockchain technology. But where an NFT differs from a cryptocurrency is that an asset like Bitcoin is interchangeable. Meaning, you couldn’t tell the difference between one human’s Bitcoin from another’s. An NFT on the other hand is totally unique. Mine would look different from yours.

That’s where NFTs can sound quite similar to ‘real’ or physical art. No two original prints are identical.

So, going back to blockchain stocks, these could be companies basing their businesses on blockchain technology, those connected to the infrastructure of decentralised finance or auxiliary firms supporting companies across the spectrum.

Even though buying NFT stocks isn’t the same as buying an NFT, you’re still exposed to the asset. So if you’re considering buying NFT stocks, there are several things to keep in mind.

First, how reliant is the stock on NFTs? Some stocks will be more closely linked to NFTs, while others might be just dipping their toe in the pond. The more they depend on NFTs for revenue, likely, the higher the risk attached.

This leads us to another consideration: how comfortable are you with risk and growth stocks? Firms just beginning to integrate NFTs into their strategy will have a lot to prove, especially as they buckle down and trim costs amid a 40-year high inflationary environment.

You also need to think about whether you believe NFTs’ track record, as an asset, will be sustainable.

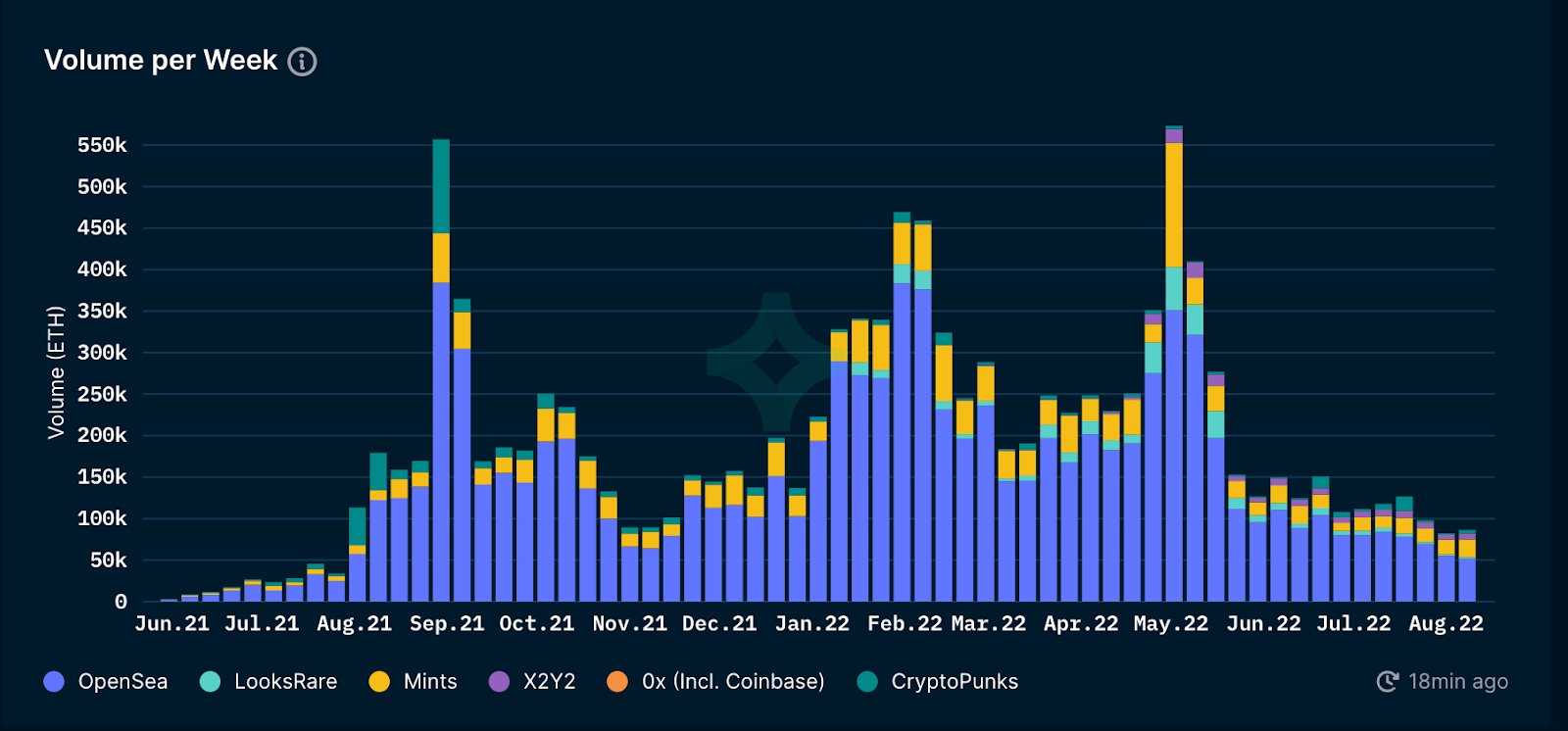

Whatever your conclusion, firms connected to the tech are banking on NFTs remaining a popular investment in the market in some way, shape or form. But that market has been slowing down a fair bit since May.

While sales peaked a few months ago, NFT transactions in terms of Ether (ETH) volume have been sliding down. Ether is the second most popular cryptocurrency in the world, behind Bitcoin, by market cap

Again, NFTs aren’t synonymous with cryptocurrencies like Ether. But cryptocurrencies are how you buy them. So they’re undoubtedly interlinked.

That volatility is crucial to have top of mind whether you’re buying NFTs directly or considering buying NFT stocks. As an emerging technology, the prices of NFTs ebb and flow frequently. And any firms banking on revenues from those innovations will be riskier investments.

That’s why it’s critical you understand and are comfortable with the level of risk involved when investing in cryptocurrency, NFTs, or stocks related to either.

NFTs to begin with are a young investable asset class. Any proof of their longevity has yet to be determined. The first NFT was made in 2014, while the first stock ticker debuted in 1867. Evidently, age isn’t everything and it certainly doesn’t prove the worth or value of an investment. But it does provide some reassurance of how long the asset class has sustained momentum or growth.

So NFTs’ proof of value will be in how long they can keep their popularity in growth mode, let alone sustained.

Yes, you can. But how you’d buy an NFT is very different to how you’d buy an NFT stock.

You’d buy an NFT from a marketplace. It’s like Amazon, but the only items on display are NFTs.

OpenSea is the largest NFT marketplace, but there are plenty of others where NFTs are available for sale too.

If you wanted to buy an NFT, you would need a cryptocurrency wallet. Without a wallet, you can’t buy or sell cryptocurrency. And without cryptocurrency, you can’t buy an NFT.

An NFT stock, however, trades on a public exchange. So it allows you, a stock market investor, to invest without the need for a crypto wallet, albeit one step removed from owning an actual NFT asset.

Remember, these companies are involved in NFT technology somehow but are not wholly reliant on NFT sales. For now, there are no publicly listed NFT-exclusive firms on any stock market.

NFTs and cryptocurrencies are very risky investments to make. While the NFT market’s tumble has meant most NFTs are now selling at a lower price, the fact that the crypto market has been sliced too makes it worse.

Because if an NFT was selling for 50ETH before, it may have a new sticker price around 40ETH instead. Meanwhile, the price of ETH itself has been decimated as well.

If, after doing your research, you decide you’d like to invest in NFT stocks, here’s how you can start.

Compare different brokerage accounts to decide which one best suits your investing habits and platform needs. Our investment fees calculator can help you understand the charges you might face.

The following NFT stocks are some of the most popular NFT investments on the Freetrade app. It’s not a suggestion of the ‘top NFT stocks to buy in 2022’. It’s just a wrap-up of some of the most popular NFT investments on the Freetrade app last year.

They aren’t listed in order, and they aren’t necessarily the best stocks or investments.

They’re just a collection of some of the NFT stocks you can find on the Freetrade app. Remember that when you invest, the value of your investments can go down as well as up. And when you invest, your capital is at risk.

Ah, McD’s. Home to golden arches, McRibs and NFTs.

The fast food franchiser launched a limited-edition NFT collection last year, giving them away to fans in anticipation of a hyped-up re-launch of the McRib.

The NFTs were digital versions of the sandwich itself. To enter for a pixelated meat sandwich, fans needed to retweet an invitation to the competition.

So McDonald’s isn’t leveraging NFTs as a revenue generator, for now. It’s using them to generate enthusiasm over a once-retired menu item. And whether or not they actually brought customers through the doors, NFTs at the very least generated a fair bit of brouhaha and McNFT headlines.

In June, eBay went from a marketplace for vintage tees and Xbox games, to one that sells NFTs too. After acquiring the existing NFT marketplace KnownOrigin, it quickly integrated the platform into its own website.

For eBay, it’s a less risky foray into NFTs. It gains access to KnownOrigin’s group of NFT makers and buyers without having to expend resources on building up that community itself.

No details were disclosed about the deal, and the firm hasn’t released an earnings statement since. So it’s unclear what revenue they’re making through the NFT marketplace.

Before KnownOrigin was acquired, it earned 15% on a primary sale commission fee. For a secondary sale, and all sales made after the first, the firm earned 2.5% in commission.

If eBay retains that fee structure, it will earn proportionally more on NFT sales than it does on physical items. Most sellers pay a 10% commission on their sales, but that can go up to 12% for books and music and down to 3.5% for musical instruments.

Funko makes figurines that look like all sorts of characters from TV and movies alike. Got a bobblehead? Well, Funko probably made them.

The firm also dabbled in NFTs last year when it launched Digital Funko Pop. These NFTs also offer buyers the chance at redeeming a free, real-life physical version of their NFT.

In its Q1 report, Funko’s revenue shot up 63% to $308.3m, and net income grew 51.7% to $9.9m.

While it doesn’t break down just how much of that revenue came from its Digital Pop Collections, the firm’s core collectable figurines saw revenue growth of 52.8%, mostly thanks to the Pop brand.

If it can continue to leverage the physical product to drive demand for the digital, Funko might be a less risky way of investing in NFTs. It isn’t purely relying on NFTs to sustain or grow in popularity. It’s also selling physical goods. The NFT looks more like the cherry on top.

Mattel has a similar NFT business model to Funko in that it links up the NFT to the physical rendition.

Luxury fashion house Balmain partnered up with Barbie to make a series of three NFTs for Mattel. But these weren’t just available for sale to anyone. You had to place a bid for a slice of the plastic pie.

The three winning bids went for $21,036, $12,287 and $8,283 respectively. After what was seemingly a fairly successful start into the world of NFTs, Mattel then signed a partnership with Cryptotoys, a toy-focused NFT marketplace.

Cryptotoys is set to launch later this summer and has investment support from Andressen Horowitz and Dapper Labs.

But backing from a venture capital firm and an NFT maker is certainly not a guarantee that if you follow in their footsteps, you’ll be making a good investment decision.

A ‘crypto winter 2.0’, referring to the next prolonged period of a downturn in the cryptomarkets (with the first being between January 2018 to December 2020 when Bitcoin crashed), could usher in a huge decline in NFT demand too.

If so, by the time the marketplace is up and running, NFTs might be cooling down.

Pearson had a problem. A cheap, used textbook is every student living on pot noodles’ dream. But it has been a piercing thorn in Pearson's side. The company’s transition to an online-first model has been a trainwreck too, keeping long-time investors like fund manager Nick Train awake for more than a few nights.

Then the firm announced plans to sell textbooks as NFTs.

In the ‘real’ world, Pearson only makes money on the first sale of a textbook from a designated shop. But once it changes hands from one student to the next, Pearson doesn’t earn additional income. And historically, a Pearson textbook will have seven owners in its lifetime.

Theoretically, NFTs would allow Pearson to keep making a commission on those sales.

The reality might be a bit murkier though. The concept of NFTs is that they decentralise the product. But Pearson is a centralised publisher that would control the entire process.

Whether Pearson’s NFTs become a novelty or actually take off for their utility won’t be known for a while.

The firm’s share price has been steadily rising this year, largely thanks to finally making headway in their online transition. Q1 earnings reported Pearson’s virtual school learning segment was growing nicely.

While NFTs are a very different product, Pearson has so far shown there’s a clear appetite for its digital learning solutions. It’ll have to make a use case that convinces textbook buyers to make an NFT purchase instead of handing £20 to a classmate though. And that may be a harder pitch to make, especially with the cost of living crunch.

Shopify has a few NFT-related projects in the pipeline.

First, it’s launching “token gated stores”. Think of these as those metal turnstile gates that usually indicate you’re at a funfair or public bathroom. But Shopify’s gates don’t make you use any old coin for entry. Instead, you’ll need an NFT.

The idea is that NFT holders get access to a Shopify customer’s exclusive merchandise or to an event. So firms partner with Shopify to use their technology.

Second, Shopify customers will be able to mint their own NFTs through the platform. They can then sell these directly from their online stores too.

While these could be easy ways for Shopify to benefit from NFTs, it'll probably take more than these efforts to turn around its stalling growth.

CEO Tobi Lütke said it himself, the firm got a bit too eager about e-commerce growth in terms of the pandemic sustaining itself post-lockdown.

Shopify’s share price has been sliced this year as lofty valuation looked even heavier following a few disappointing earnings announcements.

Coinbase launched its beta NFT marketplace this year.

The firm gave a caveat though, that it’s tough to predict how NFTs’ legal and regulatory landscape will develop, and how any changes will impact its marketplace. Coinbase could soon be subject to much tougher regulation.

While the firm hasn’t yet broken down how much it makes off its NFT marketplace, in the two weeks following the launch, it recorded under 110 transactions totalling less than $60,000. It’s way behind NFT marketplace leaders like OpenSea.

While that was just a beta test, it’s peanuts compared to transaction volumes at OpenSea, LooksRare or X2Y2. OpenSea is the world’s biggest NFT marketplace. For the 30 days ending 21 June, it recorded $785m in trades. Even that was a stark 65% tumble on the previous month’s sales.

So, Coinbase has a long way to go. For now, crypto is its bread and butter. Though, that revenue segment’s seen better days. It pulled in $1.2bn for total Q4 revenue, but operating expenses were $1.7bn. $570m for tech development costs were the bulk of that, which includes operating and maintaining Coinbase’s platform, website hosting and other infrastructure.

Blue Star Capital is an investment firm focused on eSports, blockchain and other gaming technology. It’s a UK-based NFT penny share with a very volatile history.

Penny shares to begin with are inherently riskier investments. Because of their low share price and the market exchanges they tend to be listed on, they usually have low liquidity.

That just means fewer buyers and sellers are trading the shares. But that can mean the price you see won’t be the price you get when you make the trade, which is an added hurdle and risk you’re taking with these stocks.

So NFT penny stocks are particularly risky. Especially because the business underneath is investing in emerging technology. Bear that in mind with Blue Star Capital, which also has a large holding in AQSE-listed NFT Investments.

AQSE is a stock market mostly made up of growth companies, many of which are new or still quite small. NFT Investments has a loss of £2.8m and Blue Star’s loss is £998,806. Blue Star has also yet to make any revenue on its investments, NFT Investments included.

Nvidia CEO Jensen Huang has a vision. But to see it, you’ll have to get your goggles on.

He believes the metaverse is around the corner. And once it really kicks into high gear, Huang says NFTs will be the ever-alluring digital art hanging in metaverse goers’ homes.

One of the ways Nvidia’s getting involved with NFTs is through deals with four NFT marketplaces. TurboSquid by Shutterstock, CGTrader, Sketchfab and Twinbru will all feature their marketplace content in Nvidia’s own software suite.

Nvidia’s Omniverse software is a B2B product for virtual collaboration. It can be used for 3D simulation and design collaboration among different members of a remote team. The idea is that developers can build on Nvidia’s software stack, to shorten and lighten the workload in building that up themselves.

Nvidia Omniverse is free for individuals to download, but an enterprise subscription costs $9,000 a year. Revenues in its Professional Visualisation segment (where the Omniverse Software sits) soared by 109% to $643m in Q4.

That brought its full-year revenues up by 100% to a record $2.1bn too. But as tech companies slow down amid recession fears, they’ll likely be pulling back the reins on discretionary spending (like on certain software) when possible. That could make Nvidia’s software a nice to have instead of a necessity, chipping away at possibilities of repeat subscriptions.

The American toy maker owns a lot of trademarked brands. From Transformers to My Little Pony, Hasbro has plenty of plastic toys under its belt. Those franchise brands are its biggest revenue generators, with the segment growing by 10% to $743.9m in Q2.

Hasbro’s gaming, meanwhile, has seen sales tumble post-lockdown. The revenue stream fell 14% to $125.8m. But Hasbro hopes NFTs will help it earn extra profits on its gaming and franchise brands’ collectables.

The firm already has a team exclusively devoted to those efforts. It hopes Dungeons and Dragons NFTs will be a game changer for its tech and gaming efforts. Already, without NFTs in the mix, D&D and ‘Magic: The Gathering’ earn the firm 50% of all its revenues. So even though those sales are falling, they’re still it’s bread and butter.

NFTs have a volatile track record. The NFT stocks listed here are mostly well-established companies, but it’s not to say they’ll earn you a greater return because of that. If you’re interested in the technology behind NFTs and think they could play a part in your portfolio, NFT stocks could be a less all-in way of doing so. It’s a way of giving a vote of confidence to the concept, without needing to do the guesswork yourself.

After all, the value of an NFT largely comes from the value a community of buyers ascribe to it. The value of a firm, however, should come from its revenue, profitability and business model, all of which are a lot easier to analyse and predict.

Build your financial knowledge and be in a better position to grow your wealth. We offer a wide range of financial content and guides to help you get the insight you need. For example, learn how to invest in stocks if you are a beginner, how to make the most of your savings with ISA rules or how much you need to save for retirement.

Important Information

This should not be read as personal investment advice and individual investors should make their own decisions or seek independent advice.

When you invest, your capital is at risk. The value of your portfolio, and any income you receive, can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future results.

Eligibility to invest into an ISA and the value of tax savings depends on personal circumstances and all tax rules may change.

Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales (no. 09797821).

Choose how you'd like to pay:

Annually

Save 17%

Monthly

Annually

Save 17%

Monthly

Accounts

Benefits

£59.88 billed annually

Billed monthly

Accounts

Benefits

Everything in Basic, plus:

£119.88 billed annually

Billed monthly

Accounts

Benefits

Everything in Standard, plus: